It’s an age-old question: What does a “craft beer drinker” look like?

According to market research firm Nielsen, which presented findings from its newest “Craft Beer Insights Poll” (CIP) during a Brewers Association-sponsored webinar last week, the average weekly craft beer drinker is primarily male, between the ages of 21 and 44, and makes between $75,000 and $99,000 annually.

However, those demographics are beginning to shift among less frequent consumers of craft, with 79 percent of women considering themselves monthly drinkers.

During the BA’s “Power Hour” webinar, members of Nielsen’s beverage alcohol team — Caitlyn Battaglia and Danelle Kosmal — shared the results of the fifth annual CIP survey, which was conducted by the Harris Poll between May 18-26 and commissioned by the BA.

The 20-minute online survey asked 1,100 21-plus craft beer drinkers about their consumption habits. Nielsen classified the respondents as either a “weekly craft drinker” (45 percent of respondents) or a “regular craft beer drinker” (55 percent), who drinks beer several times annually.

Here are a few takeaways from the presentation:

More adults are drinking craft beer. Overall, 43 percent of legal-drinking-age consumers quaff craft beer — up from 35 percent in 2015. Fifty-six percent of men and 31 percent of women surveyed said they drink craft, while more than half of 21- to 44-year-olds said they drink craft beer.

So why are consumers drinking more craft beer? According to Nielsen, the uptick in consumption can be attributed to a shift away from other alcoholic beverages. Other reasons include seeking more variety, better quality and more flavor options.

However, for those survey respondents who said they’re drinking less craft beer, the top reason for cutting back was that other alcoholic beverages were being consumed instead, followed by efforts to live a healthier lifestyle and reduce caloric intake.

The BA’s independence seal is factoring into purchasing decisions. According to Nielsen, 42 percent of craft drinkers said they had seen the seal, and nearly a quarter of them said they had bought a beer with the seal on the package. Of the consumers who had seen the seal, about half of them were converted into buyers, which Battaglia called “a good conversion rate.”

Those numbers increased for weekly craft beer consumers, with more than half saying they’d seen the seal, and 31 percent saying they’d purchased a craft beer featuring the badge.

“Those numbers go up considerably among younger drinkers,” Battaglia added. “When we look at that 21- to 34-year-old craft drinker, in particular, 60 percent were aware of the seal.”

The survey also asked respondents how likely they were to buy a beer featuring the BA’s independence badge. Nearly half of regular craft drinkers — 46 percent — said they were more likely to buy a beer because of the seal, while 58 percent of weekly craft beer drinkers said the seal would entice a purchase.

Meanwhile, 41 percent of craft drinkers and 38 percent of weekly craft consumers said the seal made no impact on their purchasing behavior. Only 2 percent of craft drinkers, and 4 percent of weekly craft drinkers, said they were “less likely” to purchase a beer with the seal featured on the packaging.

According to Battaglia, the BA can build upon this momentum, with “really good awareness” that is tied to purchasing intent.

Local is important to craft drinkers. Nielsen found that 66 percent of craft drinkers said they only buy beer sold in their region, while 57 percent said they only buy beer sold in their town or city. The numbers were higher for weekly craft drinkers, with 71 percent saying they only buy regional and 62 percent saying they buy local.

Local craft accounts for 10.3 percent of craft dollar sales, up about 1 percent from 2018. Local craft 6-packs also command a higher average off-premise price at $14.34, compared to $9.26 for the average craft 6-pack. This shows that consumers are willing to pay a premium for local beer, Kosmal said.

BA-defined craft beer is growing dollar sales and gaining share of total beer in off- and on-premise retailers. Nevertheless, craft beer growth has slowed to low-single-digit growth.

For the 52 weeks ending June 15, off-premise dollar sales of beer/FMB/cider were up 1.2 percent. BA-defined independent craft is outpacing the overall category, up 2.4 percent.

Meanwhile, total category volume sales declined 1 percent, while independent craft volumes grew nearly 1 percent.

At on-premise retail accounts, dollar sales increased for both total beer/FMB/cider (+0.5 percent) and independent craft (+2.8 percent), according to Nielsen CGA.

The trend of dollar sales outpacing volume sales also shows that consumers are continuing to “trade up” for higher end offerings, such as craft beer, imports, FMBs, super premiums, and cider, Kosmal said.

Sales of spirits are accelerating. Also through June 15, off-premise dollar sales of spirits increased 4.7 percent, while wine sales grew 1.9 percent, Nielsen reported. On-premise sales for both spirits (+2.1 percent) and wine (+1.3 percent) are also on the rise.

“At a total category level, spirits is leading and has in fact been widening its growth lead over the last couple of years,” Kosmal said. “Beer is lagging, with wine in the middle, and its growth rate slowing.”

Hard Seltzer is on pace to be a $1 billion industry by the end of 2019. The hard seltzer segment is growing triple digits, following a strong July 4 holiday week, Battaglia said.

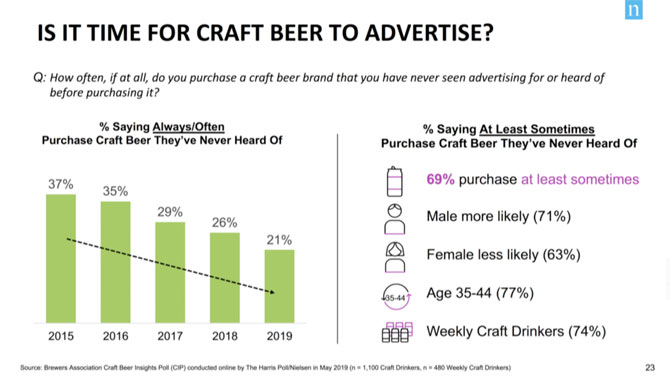

The time is now for craft beer beer to advertise. The percentage of craft beer drinkers who say they “always/often” buy a craft beer that they haven’t heard of is on the decline, Kosmal pointed out. In fact, just 21 percent of the respondents said they “always/often” buy craft beer they’ve never heard of — down from 37 percent in 2015.

“I would say that now is the time for brewers to ramp up marketing efforts to build and track brand awareness and to lean into the business side of owning a brewery,” Kosmal said.

Those purchasing decisions were divided along gender lines. Seventy-one percent of male craft beer drinkers said they are more likely to at least buy something they’ve never heard of, while 63 percent of women surveyed said they were less likely to buy a beer they didn’t know about.

Consumers are starting to find their favorite brands. Three quarters of consumers said they buy up to three beer brands a month. Meanwhile, the number of “promiscuous consumers” who buy five or more brands a month has declined over the last five years, Kosmal said.

“Drinkers today are less likely to experiment across brands, at least compared to five years ago,” she said. “To me, this says that your brand recognition and equity that you have built or are building with your core drinkers is becoming increasingly more important.”

Brewery visits help drive future retail sales. More than half of craft drinkers said they bought beer after a brewery visit. The top three places to buy beer after a visit? At the brewery (66 percent of craft drinkers), retail store (60 percent), or a bar or restaurant (54 percent).

Meanwhile, the top three occasions for consuming craft beer are drinking at home with friends and family (63 percent), eating at a restaurant (56 percent) and visiting at a friend’s home (50 percent).

There’s been “a slight downtick” in the average number of brewery visits. In the last 12 months, regular craft drinkers made 2.4 visits to a brewery within a couple hours of their homes, while weekly craft drinkers made an average of 3.4 visits.

“Here we see a little bit of the decline or a little bit of stagnation and not a lot of growth,” Battaglia said.

The top reasons people visit breweries remain sampling, education and trying exclusive offerings. Sampling opportunities are “even more important for female craft drinkers,” with 55 percent saying that’s why they visit breweries, Battaglia added.

“The fact that they’re coming into breweries and tasting rooms to sample beer is a great way to continue to engage with and capture those female drinkers and take advantage of the fact that is something they’re specifically looking for,” she said.