Editor’s Note: Kary Shumway is the founder of Beer Business Finance and Craft Brewery Finance, online resources for beer industry professionals. He has worked in the beer industry for more than 20 years as a certified public accountant and a chief financial officer for a beer distributor. He currently serves as CFO for Wormtown Brewery in Worcester, MA.

Craft Brewery Finance publishes a weekly beer industry finance newsletter, offers guidebooks on topics such as cash flow planning and basic budgeting, as well as an online course on improving taproom profits. The newsletter — with a free trial, industry guides and resources — is available at www.craftbreweryfinance.com.

Taproom-focused breweries have emerged as one of the most popular business models in the craft beer industry, and for good reason: These small-batch, retail-driven breweries are profit machines, and they are disrupting the traditional three-tier system of brewing, distributing and retailing beer.

With that disruption comes new opportunities, new ideas and new ways of conducting business. But disruption may also come at a cost. Many small breweries grow too quickly and lack a well-polished financial plan. Rapid growth, absent a good plan, can lead to financial trouble.

In an effort to avoid running into financial hardships, and ensure that rapid growth doesn’t come at the expense of profitably, let’s take a look at how new craft brewery owners can create a solid financial plan for their taproom-minded outfits. Remember that disruption is only good if you remain cash-flow positive.

Taproom Financial Basics

Let’s start with some basic terms. These might appear to be complex accounting concepts, but they are easy to understand once you break them down.

- Chart of accounts

- General Ledger

- Financial reporting

These are the building blocks of a financial system, and understanding these terms will benefit all retail-minded brewery owners as they review and refine their taproom financial reporting.

The Chart of Accounts

The chart of accounts is simply a listing of all the things you want to track on your brewery financial reports. The list includes different types of revenue, expenses, assets, and liabilities.

For taproom-focused breweries, revenue includes draft beer, packaged beer, growler sales and merchandise. You could make this list as broad or narrow as you like, it all depends on how detailed you want your financial reports to be.

Expenses include wages, benefits, the cost of the beer, utilities, insurance and supplies.

The purpose of the chart of accounts is to categorize these different items so that you can organize and report on them in summary or detail.

An important takeaway is that you must separate your taproom accounting from the rest of your brewery. Treat the taproom like a separate business so that you can see the specific results. The chart of accounts allows you to do this (see example below).

- Revenue – Brewery

- Revenue – Taproom

- Salaries – Brewery

- Salaries – Taproom

From this list, you can create a separate sales or expense account for every relevant item you want to track. We’ll dig into this in more detail, but for now, just remember to create separate accounts to track taproom-only sales and expenses.

Examples of the Chart of Accounts

As noted, the chart of accounts is a list of revenue and expense items. The list is made up of descriptive words to help you identify what type of activity goes into each account.

In addition to the description, the listing uses numbers to keep things organized. The numbers make it easier to sort and group the categories.

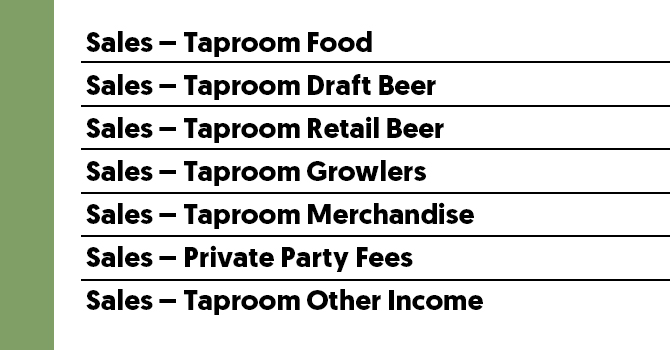

Below is an example of how taproom sales appear in the chart of accounts.

And here is the same chart of accounts with numbers to assist with sorting.

While the numbers make it easier to sort the information, they also look intimidating. Don’t let the numbers distract you or scare you off — simply focus on the account description and the information it presents.

The General Ledger

We know that the chart of accounts is the list of all your revenue and expense items. Similarly, the general ledger is where all the detailed transactions get recorded.

For example, when you make a taproom sale, the transaction is recorded in the general ledger. Likewise, when you pay wages to taproom staff, the general ledger records an entry.

Think of the general ledger as a big, dusty accounting book where all of the records are kept. All of the sales and expense details, customer transactions and vendor payments end up in the general ledger. Once all the details are in the general ledger, they are summarized and molded into the financial statements.

The Financial Statements

In addition to the chart of accounts and the general ledger, a well-structured taproom-focused brewery needs to maintain accurate financial statements, which can be thought of us summarized reports.

The financial reports answer the most important questions: Did the business make any money? How was cash flow? What is the company’s net worth?

The income statement, balance sheet, and cash-flow statement make up the “big three” financial reports. Taken together, these three statements provide a rounded view of the financial results and overall health of the business.

The income statement records sales, expenses and net income. It tells you whether you had a profit or loss for a period.

Sales – expenses = net income

The balance sheet records assets, liabilities, and equity. It tells you what you own and what you owe at a specific point in time.

Assets – liabilities = equity

The cash-flow statement records cash activity. Think of this like a checkbook register. It shows your bank balance, cash that came in and cash that went out. The income statement and balance sheet measure “transactions,” but the cash-flow statement measures cash.

In Summary

Taproom-focused breweries are having a significant impact on the traditional beer industry. Despite their small size, these breweries can be very profitable, provided they have a solid financial plan.

If you’re a new taproom-focused brewery owner, now you have the building blocks to create your own financial reporting and understand the differences between a chart of accounts, a general ledger, and financial statements.

A key starting point is to set up the chart of accounts so that you can track the results of the taproom separately from brewery operations. This will give you a clear visual of the financial results of the different cost centers of the business.