Editor’s Note: Kary Shumway is the founder of Beer Business Finance and Craft Brewery Finance, online resources for beer industry professionals. He has worked in the beer industry for more than 20 years as a certified public accountant and a chief financial officer for a beer distributor. He currently serves as CFO for Wormtown Brewery in Worcester, MA.

Craft Brewery Finance publishes a weekly beer industry finance newsletter, offers guidebooks on topics such as cash flow planning and basic budgeting, as well as an online course on improving taproom profits. The newsletter — with a free trial, industry guides and resources — is available at craftbreweryfinance.com.

The savviest craft brewery owners are constantly on the lookout for creative ways to increase sales. The introduction of unique beer styles, diverse package types and non-traditional offerings often top the list of ways to improve revenue as breweries attempt to satiate consumer demand for new products.

The term “rotation nation” has been used to describe the current state of the on-premise environment: bars and restaurants that routinely swap out ‘old’ beer handles for the latest releases. This phenomenon has compelled breweries to make a wide variety of beers so that they can participate in the rotation game.

But for all the focus on sales growth, innovation and keeping up with rotation nation, how many breweries are paying attention to product margins?

Product margin is the difference between what a beer costs to make and what it is sold for. It’s an important number to ensure breweries remain profitable and cash-flow positive.

Not all products in a craft brewery’s portfolio are equally profitable. Keg beer and packaged beer, for example, can have drastically different margins. Meanwhile, the margins on a flagship beer may also be very different from one-off beers designed for rotation nation.

In this month’s column, we’ll examine what the different products in your portfolio actually cost to make, and how to price them so you make healthy margins.

Back to Basics: Beer Pricing, Margins, and Costs

Pricing

In the beer world, there are three layers of pricing: price-to-wholesaler, price-to-retailer, and price-to-consumer.

Breweries that sell their beer to a wholesaler charge a PTW (price-to-wholesaler). The wholesaler then sells the beer to the retailer and charges a PTR (price-to-retailer). The retailer, in turn, sets the PTC (price-to-consumer).

It’s important to understand the pricing structure at each layer in the sales process so that you get your beer on the shelf at a competitive price point while maintaining a proper margin.

Margins

Beer margins are the difference between sales and cost of goods sold (COGS). Margins are calculated by subtracting the cost of goods sold from the price of the beer.

Costs

Beer costs, or more specifically the cost of goods sold, are all the costs that go into making your beer. These include raw materials, labor, and overhead costs of your brewery. We’ll look at a few examples below.

Average Cost of Beer

Everyone loves metrics and benchmarks, so let’s talk about these as they relate to beer costs. While the numbers below are hypothetical, you can apply the concepts presented to set the costs of your own products.

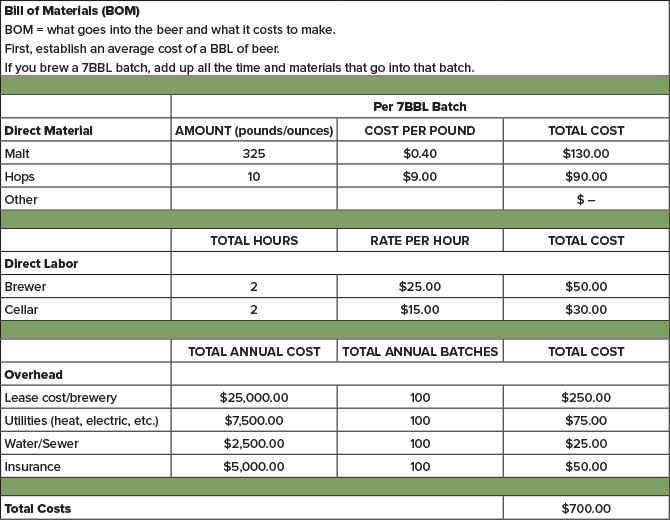

A first step is to calculate the cost of the beer (the liquid). This is done by costing out a full batch of beer – the direct materials, direct labor, and overhead.

Next, add the specific costs associated with each type of package: kegs, cans, bottles, etc.

The bill of materials (BOM) is the detailed listing of these costs. The BOM is all the stuff that goes into making your beer: the ingredients, the time and labor to make the beer, and the costs of brewing equipment and utilities needed in the process. To illustrate, below is a simplified example of a bill of materials.

Cost of the beer:

Once you have the cost of the beer, it’s time to layer in the cost of the packaging materials. Let’s look at an example of a case of 16 oz. cans.

Average Beer Margins

Earlier we talked about the terms used in beer pricing: PTW, PTR, and PTC.

At each step along the supply chain, a business has to make money. The beer wholesaler, retailer, and brewery need to make a proper margin in order to stay profitable and stay afloat.

Below, is an example of hypothetical pricing and margins on beer. In this case, the wholesaler and retailer each need to make a 30 percent margin. Further, let’s say you want a 4-pack of 16 oz. cans of your beer on the retail shelf for $11.99.

In the example above, the beer on the shelf is selling for $11.99. The wholesaler, retailer, and brewery are making their required margins. This template is useful when pricing new beers so that you can achieve necessary financial targets.

In Summary

Brewery sales growth and variety in your beer portfolio is vital to success. However, don’t forget to mind your product margins as you’re growing sales.

Learn about the costs that go into your beer: direct materials, direct labor, and overhead costs. Analyze how these costs fluctuate across different beer packages and styles.

Use the costing and pricing templates provided here so that you can properly price your beer at retail. Everyone needs to make money when it comes to selling beer – the wholesaler, the retailer, and most importantly, your brewery.

Want to dive deeper? Check out this explainer video.