Florida’s Cigar City Brewing, which sold to the Fireman Capital-backed Canarchy Craft Brewery Collective in 2016, is quickly emerging as the consortium’s most promising brand.

Growing at more than 60 percent year-to-date, the Tampa-based craft brewery has already shipped more than 107,000 barrels of beer through the first nine months of 2018 and is on pace to produce an estimated 143,000 barrels.

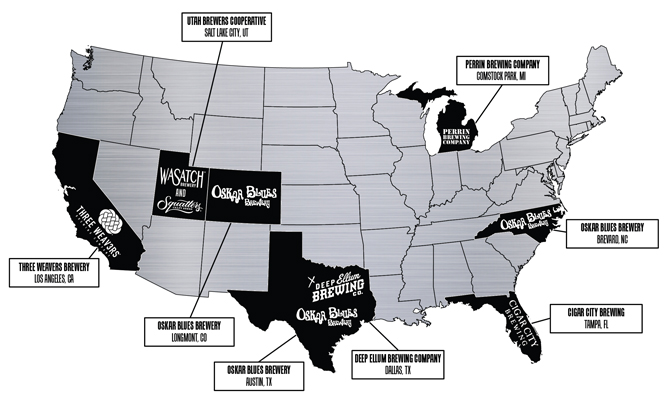

Canarchy — whose other brands include Oskar Blues, Deep Ellum, Perrin Brewing, Three Weavers, and Utah Brewers Cooperative (Wasatch and Squatters) — ranked as the ninth largest craft brewery in 2017, according to trade group the Brewers Association.

At the time, Oskar Blues was the leading brand, accounting for about 50 percent of the 359,000 combined barrels the collective produced.

But Cigar City, which has expanded distribution into 17 new states since joining the collective, is now poised to become the group’s largest offering.

In an update shared with Brewbound, a Canarchy spokesperson cited access to additional brewing capacity, distribution networks, and integrated sales and marketing teams as reasons for Cigar City’s success in 2018.

The spokesperson added that a packaging refresh, as well as the introduction of 16 oz. cans and 12-packs for Cigar City’s flagship Jai Alai IPA, have also contributed to the company’s growth this year.

Canarchy, citing data from market research firm IRI, said off-premise dollar sales of all Cigar City offerings are up more than 60 percent through September 25, outpacing three Anheuser-Busch-owned craft brands: Golden Road, Elysian, and Karbach.

Sales of Cigar City beer are also growing faster than Founders Brewing, helping drive Canarchy-wide sales trends up 14 percent on the year, the company added.

Meanwhile, sales of Jai Alai IPA are up more than 67 percent, making it the third fastest growing top 50 craft brand in the U.S., according to IRI. It trails only Elysian Space Dust IPA (+75 percent) and Blue Moon White IPA (+307 percent), according to data shared by Canarchy.

In June, Canarchy told Brewbound that off-premise sales of Oskar Blues’ flagship Dale’s Pale Ale were up 7.7 percent through the first six months of the year.

Also through June, Three Weavers’ depletions were up 90 percent. Approximately 85 percent of that company’s beer was sold on-premise in 2017, and founder Lynne Weaver recently told Brewbound that her company has “a huge amount of white space on the chain side.”

“It was LA County, Orange County, San Diego, and that was predominantly draft,” she said. “And now, we are moving forward into more chain placements, hopefully in the spring, and moving up into Northern California, which I am super excited about.

“All of those opportunities will end up driving an even faster growth rate,” she added.

Three Weavers produced approximately 5,420 barrels of beer last year and is on pace to produce upwards of 12,000 barrels in 2018.

Deep Ellum, meanwhile, made about 45,000 barrels of beer in 2017 and was growing at 15 percent when it sold to Canarchy in June.

Last year, Canarchy’s portfolio-wide sales increased 2 percent, to 359,516. However, sales of Oskar Blues products declined 11 percent, to 179,544 barrels. Utah Brewers Cooperative sales also declined 6 percent, to 58,277 barrels.

Combined, the seven companies could produce as much as 450,000 barrels in 2018.