Midway through 2018, the Canarchy Craft Brewery Collective is outpacing the overall U.S. craft beer segment.

The Brewers Association (BA) reported last week that growth for small and independent U.S. brewers had “stabilized,” with production growing 5 percent through the first six months of 2018.

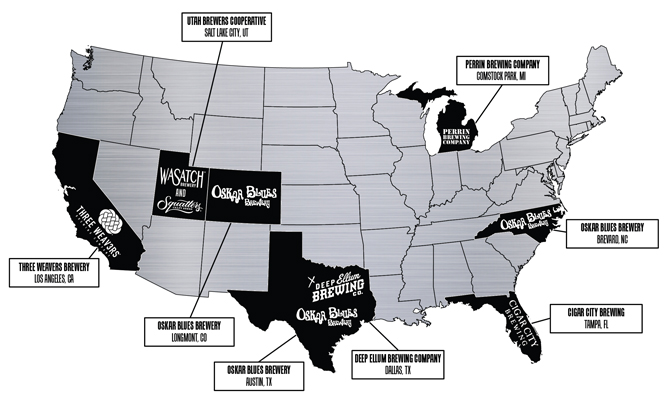

The Fireman Capital-backed brewery consortium — whose brands include Oskar Blues, Cigar City, Deep Ellum, Perrin Brewing, Three Weavers, and Utah Brewers Cooperative (Wasatch and Squatters) — is growing faster than the category, with off-premise sales up 15.4 percent in market research firm IRI Worldwide’s total U.S. multi-outlet and convenience store channel year-to-date.

In an email to Brewbound, Canarchy spokesman Chad Melis said the platform is “aggressively positioned to grow and scale.” The company acquired Texas’ Deep Ellum and California’s Three Weavers over the course of the last two months, and is ranked by the BA as the ninth largest U.S. craft brewery, with 10 brewing locations throughout the country.

Melis offered a few highlights of Canarchy’s year so far.

Cigar City depletions are up 76 percent midway through the year, Melis wrote. He added that sales of flagship Jai Alai IPA are up 63 percent, growth he attributed to continued success in the brewery’s home state of Florida, as well as the addition of new markets (the Tampa-based brewery’s products are now available in 22 states). Jai Alai is currently the third best selling canned craft beer in the U.S. (No. 27 overall), and the brand is also the top selling craft offering in 6-packs.

“Canarchy is able to provide expanded CCB capacity to meet fanatical demand in existing markets while leveraging the platform’s distribution network and national sales team to support those markets,” Melis wrote in an email to Brewbound.

Sales of Oskar Blues’ flagship Dale’s Pale Ale are up 7.7 percent through the first six months of 2018, and 6-packs are also now the third-best selling craft canned product, Melis wrote.

Meanwhile, Mama’s Little Yella Pils depletions are up 11 percent, and G’Knight Imperial Red IPA has grown 121 percent.

Sales of Oskar Blues 16-packs have also increased by more than 100 percent, and the company’s “CANundrum” 24-packs are up more than 400 percent year-over-year, with most sales coming in Costco stores.

After acquiring Deep Ellum, Canarchy now has four of the top 30 best-selling craft 6-packs. Deep Ellum Dallas Blonde sales are up more than 33 percent, while portfolio wide sales are up 24.9 percent.

So far this year, Three Weavers’ depletions are up 90 percent. Melis wrote that the plan is to grow Three Weavers’ production and expand within its wholesaler network. Three Weavers sales are up 69.2 percent, led by an 86 percent increase in Expatriate IPA sales.

Perrin 15-packs are up 1,400 percent through June 30. Those packs now account for 85 percent of the company’s total package volume through the end of June.

Squatter’s Hop Rising, the brewery’s largest volume SKU, is up 6.29 percent.

Last year, Canarchy’s portfolio-wide sales increased 2 percent, to 359,516. However, sales of Oskar Blues products declined 11 percent, to 179,544 barrels. Utah Brewers Cooperative sales also declined 6 percent, to 58,277 barrels.

But sales of Cigar City and Perrin Brewing beers increased 41 percent (92,185 barrels) and 33 percent (30,000 barrels), respectively, driving total growth for the company.

Prior to joining the Canarchy platform, sales of Deep Ellum and Three Weavers products increased 37 percent (45,264 barrels) and 93 percent (5,420 barrels), respectively, in 2017.