Most notably, the company will be making a capital investment to launch custom bottles for its Kona Brewing and Redhook Brewery lines. But while those are going on, it is also putting together new packages designed to help its brands, which have seen their greatest success in supermarkets, cross over into convenience channels.

The changes come as CBA’s share price saw a significant decline in value through the second half of 2012, and when its most experimentally focused brand, Widmer, is experiencing declining sales. According to Andy Thomas, the president of commercial operations, the company is working on shoring up its portfolio, particularly Widmer, through a packaging approach.

“In true portfolio management style, we don’t want any of our brands to sit on top of each other,” Thomas said. “The overall strategy is to allow each brand portfolio to grow and mature to its overall consumer base and packaging is a big part of that. You have to dress the part.”

So here’s the wardrobe:

“I am a big believer that brands are like people,” he said. “I believe you need something to rally around. For a brand like Kona, which is so anchored in Hawaii, being in a stock bottle didn’t feel appropriate.”

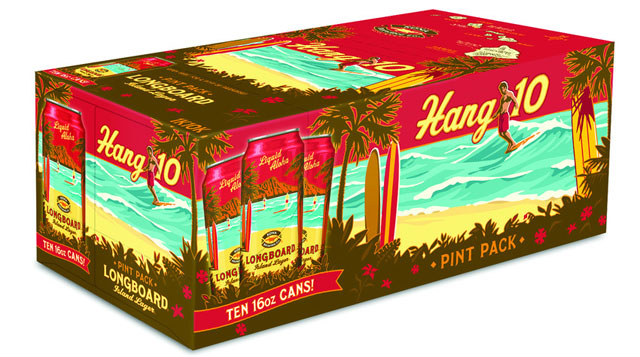

The custom bottle — which Thomas said resembles the shape of a surfboard — isn’t the only new package introduction for a Kona brand that saw sales spike 22 percent during the third quarter of 2012. The company is currently rolling out a “Hang 10” pack of 16 oz. Longboard Lager cans that will retail for $15.99.

“Hang 10 is such a part of the ethos of Hawaii,” said Thomas. “It makes sense that an authentically Hawaiian brand would bring that forward.”

CBA also plans to introduce new packages on its Redhook brand this year, Thomas said. The company is fitting the shape of its existing, custom 12 oz. bottles for a 22 oz. offering. It’s also launching Longhammer IPA in 16 oz. canned 4-packs in March.

It’s the latest in a two-year series of changes to the Redhook brand. Brady Walen, CBA’s marketing and communications manager, said the company examines brand personalities before making any decisions on new packages.

“We think about beer drinking occasions and what cans or bottles are best suited for,” said Walen. “The new packages made sense and felt right for both brands.”

It’s been harder to find the right look and feel for Widmer — it’s about to undergo its second facelift in less than two years. The brand was down 3.7 percent in food, drug, convenience and mass market retail through the 52-week period ending Dec. 2, 2012.

“The changes we made to the Widmer Brothers packaging [in March, 2011] separated it from Redhook and Kona but it didn’t accomplish on delivering the Widmer Brothers position,” said Walen.

According to Thomas, Widmer fell victim to “brand creep,” explaining that over the last ten years, Widmer has slowly wandered away from its original identity.

“Somewhere along the way, we lost it,” he said. “We were missing that strong face on the Widmer Brothers brand and now we are reclaiming the romance.”

“We are trying to feature the ‘W’ prominently and make it a visual cue that lets consumers know it is definitely a Widmer Brothers beer,” Walen said.

Using the ‘W’ as its beacon, the company will also change the name of the “924 Series” to the “W” series, one that includes Pitch Black IPA and Nelson Imperial IPA as year-round offerings, as well as three limited releases distributed periodically throughout the year.

Thomas said the changes to all three brands are part of a broader retail strategy, one that will include a bigger push with Kona and Redhook in the convenience channel.

“If we are going to play with the c-store consumer, we need to get more into large format and can packages,” he said. “That is what that consumer is looking for, that is the mindset that they are in. We are starting to make decisions that, I think, make sense for what the brand is, what consumer the brand is targeting and what occasion it is trying to satisfy.”